Why Us

Top-Down and Bottom-Up Research To Capture Innovation Early

ECP Incorporates Sustainability Intrinsically

Invest For Long-Term Growth

Invest For Long-Term Growth

Align Process With SDGs

ECP Incorporates Sustainability Intrinsically

ECP’s Investment Process

Top-Down Research

To define the investment universe, ECP’s investment process initially examines how the world is changing and where it is headed.

Bottom-Up Research

To refine the investment opportunity, ECP’s bottom-up analysis evaluates potential investments based on our defined key metrics.

Ideation

Identify Disruptive Innovation

Stock Selection And Valuation

Select Portfolio Companies

Sizing The Opportunity

Define The Potential Universe.

Portfolio And Risk Management

Monitor Conviction & Market Volatility

Receive Regular Updates And Notifications On ECP’s Latest Research Because Investing In Innovation Starts With Understanding It

ECP’s Investment Process

Transparent Leverage

Our ETPs provide transparent long & inverse leverage, subject to oversight by financial regulators. They can be traded like stocks and are backed by physical assets.

Liquidity

The liquidity of our products is guaranteed by a designated market maker. We make easy for investors to execute and exit from tactical trades.

Cost-efficient Structure

Compared to OTC products and CFDs, there is no extra cost for holding a position overnight. Our ETPs also trade in multiple currencies which are quoted using institutional FX rates.

Tax Efficiency*

Withholding tax on US-source dividends is 15% for our ETPs vs. 30% generally for non-US persons investing in US shares or in many financial products linked to US shares.*

Top-Down Research

To define the investment universe, ECP’s investment process initially examines how the world is changing and where it is headed.

Bottom-Up Research

To refine the investment opportunity, ECP’s bottom-up analysis evaluates potential investments based on our defined key metrics.

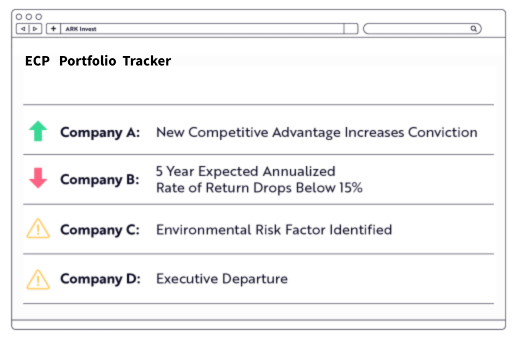

Portfolio And Risk Management

Monitor Conviction & Market Volatility

Ideation

Identify Disruptive Innovation

Stock Selection And Valuation

Select Portfolio Companies

Sizing The Opportunity

Define The Potential Universe.

Portfolio And Risk Management

Monitor Conviction & Market Volatility

Receive Regular Updates And Notifications On ECP’s Latest Research Because Investing In Innovation Starts With Understanding It

How to Gain Exposure

Our margin-based ETF Make buying stocks on leverage accessible, cost-efficient, and transparent. Investors are protected against losing more than their initial investment although the whole initial investment can be lost. They do not need to open a margin or futures account and face no requirements to margin levels.

See how our ETF compare to other financial instruments:

| Potential Ways to Gain Magnified Exposure | Futures | Option | Spread Betting / CFDs | Warrants / Turbos | Leveraged Certificates | Eisberg Capital Partners ETF 1 |

|---|---|---|---|---|---|---|

| Constant Leverage Factor |

|

|

|

|

|

|

| Losses Capped at Invested Amount | ||||||

| Low Minimum Trade Size | ||||||

| No Maintenance Margin Required | ||||||

| No Margin Account Required | ||||||

| Physically-Backed | ||||||

| Dedicated Market Maker | ||||||

| No Bank Credit Risk2 | ||||||

| Traded on a Regulated Exchange |

¹ Eisberg Capital Partners are margin-based ETF that provide 5x,

4x, 3x, 2x,

-1x -2x,

-3x, -4x & -5x exposure to individual stocks & ETFs.

²

Although

credit risk is reduced, other risks still apply.

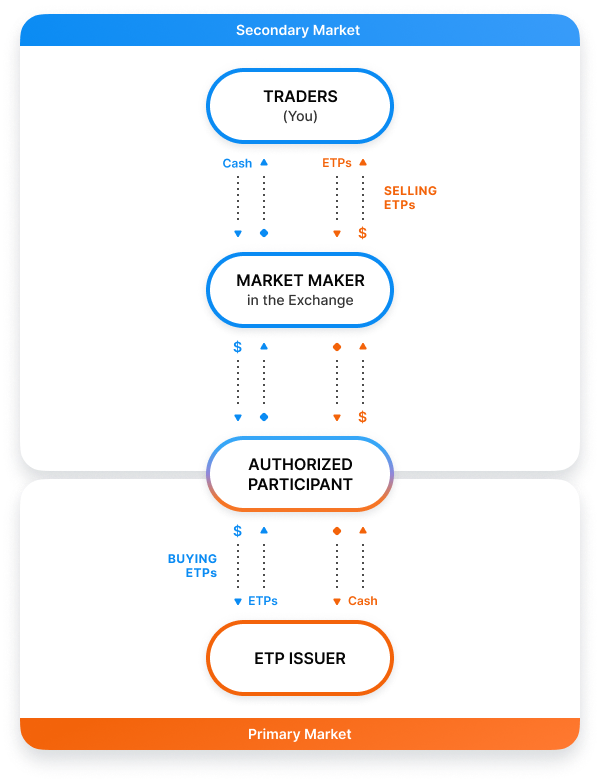

How Our ETFs Work

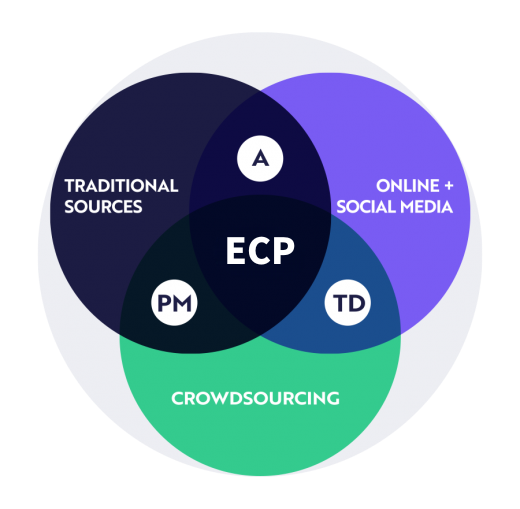

ECP’s Open Research Ecosystem

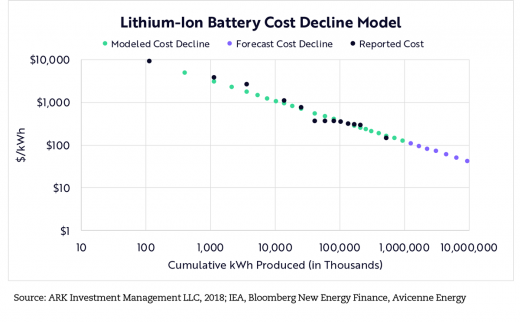

Research Model Example

Bottom-Up: Portfolio and Risk Management